Growth

Strategy

WHAT AFFECTS US

WHAT WE DO

– Indian economy

– Indian healthcare industry

ASSET MANAGEMENT

AND ENHANCEMENT

In FY2015, the RHT portfolio saw a

total of 103 beds added organically and

344 operating beds added inorganically

via the acquisition of the Mohali Clinical

Establishment.

RHT actively seeks to enhance its existing

portfolio in consultation with the operator

of the assets. These involve upgrading,

refurbishment works and reconfiguration

of the facilities in the clinical establishments

in RHT’s portfolio to enhance and

maximise their operational efficiency and

competitiveness.

Planned Capacity Enhancement

Initiatives

s

Addition of a 200 bed Oncology block

at BG Road Clinical Establishment

.

s

Addition of a Maternal and Child

Health (“MCH”) program at Noida

Clinical Establishment which would add

40 beds by FY2017.

s

Addition of 50 beds at Mulund Clinical

Establishment.

s

Addition of 40 beds at Jaipur Clinical

Establishment.

s

Addition of 102 beds at Amritsar Clinical

Establishment by FY2017.

s

Addition of 60 beds, two operating

theatres and a catherisation laboratory

at Nagarbhavi Operating Hospital.

Greenfield Clinical Establishments

RHT has four Greenfield Clinical

Establishments in its portfolio – Ludhiana,

Chennai, Hyderabad and Greater Noida.

These four clinical establishments have a

potential bed capacity of 874 beds. A new

79 bed hospital at the Ludhiana Greenfield

Clinical Establishment is currently under

development and is expected to be ready

by FY2017.

INVESTMENTS

Right of First Refusal (“ROFR”) Assets

Fortis, the sponsor of RHT, has granted

RHT the Right of First Refusals (“ROFR”)

over the Clinical Establishment that

it owns. Where Fortis intends to dispose of

any of its Clinical Establishments, it must

first have to be offered to RHT. Currently

the Clinical Establishments owned

by Fortis which are potential ROFR

assets, are relatively young hospitals.

RHT will have the opportunity to

evaluate and acquire these assets from

Fortis when they are operationally stable.

Fortis is focusing its efforts on the Indian

healthcare market and disposed of all

its international healthcare operations.

With Fortis concentrating on the Indian

healthcare market, they may develop more

Clinical Establishments. Such Clinical

Establishments will also be potential

ROFR assets.

Potential Third Party Acquisitions

We are always on the lookout for attractive

yield accretive acquisitions to enhance

RHT’s portfolio. We focus our efforts in

sourcing for Clinical Establishments which

are suitable for the provision of multi-

specialitymedical services. In the near future,

we are intending to remain in India where

we have the ground knowledge and network

for sourcing for potential acquisitions.

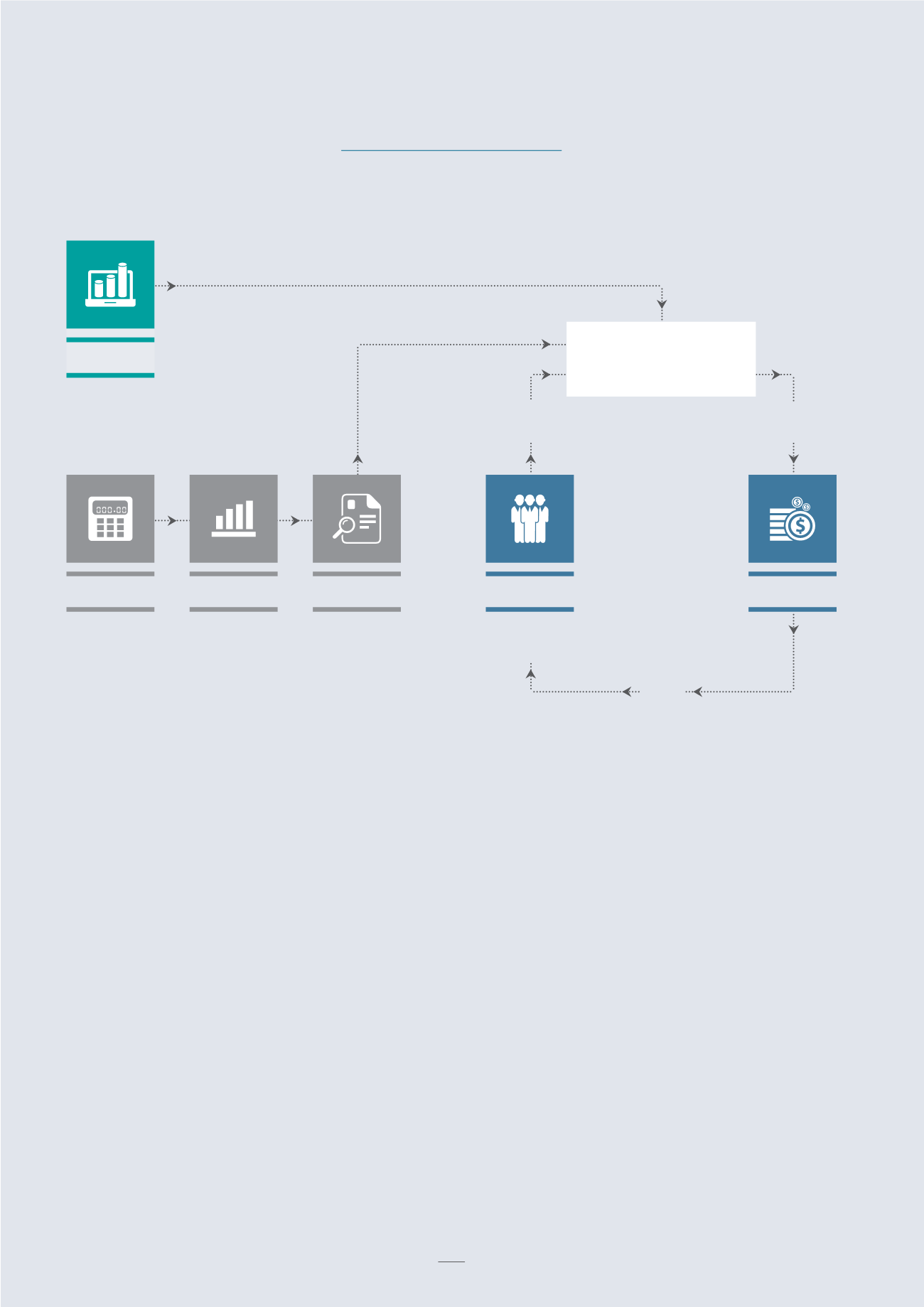

MARKET

FACTORS

INVESTMENT

MANAGEMENT

ASSET

MANAGEMENT

DPU

REVENUE

UNITHOLDERS

Services Fees &

Other Income

Owns RHT

Units

CAPITAL

MANAGEMENT

– Fortis Healthcare Limited ("Fortis")

– Institutional & public investors

RHT

RELIGARE HEALTH TRUST

12