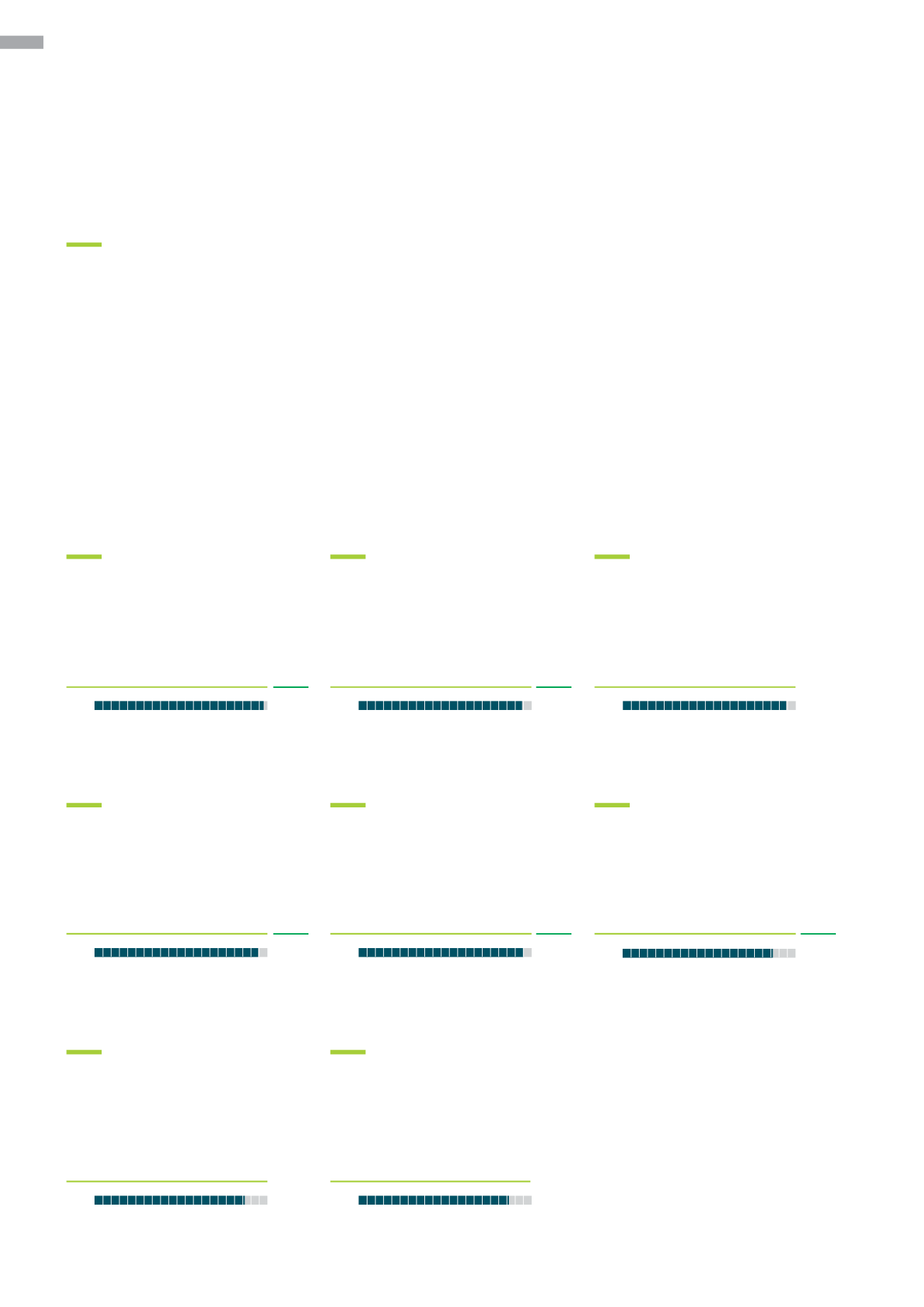

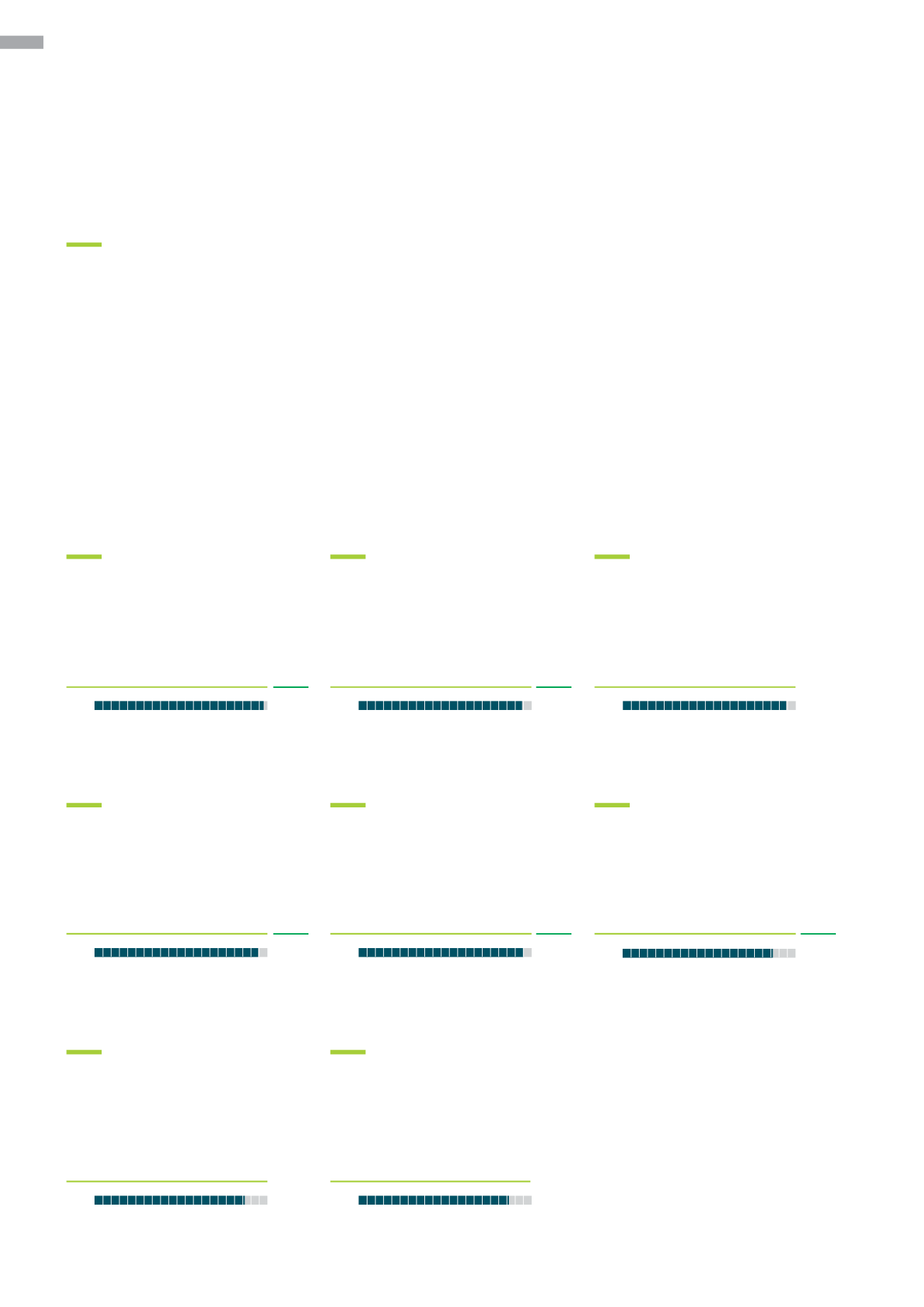

Financial

Highlights

Long term contracts coupled with a fee

structure with downside protection provides

stable distributions for unitholders.

*

Exchange rate for actual FY15 and FY16

was INR47.41 and INR47.36 respectively.

†

Excludes straight-lining, depreciation and

amortization

^

No new contract was entered into in FY16

Net Service Fee and

Hospital Income*

†

S$

93.61

m S$

61.58

m

2%

6%

Distributable

income

91.56m

FY15

58.17m

FY15

75

%

OCCUPANCY

74%

FY15

return

on EQUITY

Weighted Average

CONTRACT Expiry

8.33

%

11.3

years

12.3 years

FY15

7.56%

FY15

Distribution

per unit

average revenue

per operating bed

6%

7.72

¢

5%

14%

INR

13.37

m

12.76m

FY15

7.32¢

FY15

BUSINESS

Value

S$

1,129

m

991m

FY15

FY16

FY16

FY16^

FY16

FY16

FY16

FY16

FY16

002

Religare Health Trust