Capital Risk

Management

Capital RiskManagement

The Trustee-Manager employs an

appropriate mix of debt and equity for

the financing of the acquisition and

enhancement initiatives of the medical and

healthcare assets in the RHT portfolio.

As at 31 March 2016, RHT has a net debt of

S$164.2 million with a gearing approximately

18%. RHT may increase its borrowings by

S$445.7 million before reaching its internally

set limit of 45% which is in line with the

gearing limits set out under the MAS REIT

guidelines in Singapore, leaving room for

future growth opportunities. A S$500m

Medium Term Note Programme (“MTN

Programme”) was established for RHT in

FY2015.

In view of ongoing and future asset

enhancement initiatives like that for BG

Road CE, Ludhiana CE, FY16 projects and

acquisition of land for the expansion of the

Mohali CE, RHT’s gearing ratio will rise to

approximately 21.9% if the expected capital

expenditures were fully incurred.

Refinancing Risk

During the year, the Trustee-Manager issued

S$60m fixed rate notes at 4.5% for the

repayment of the S$60m DBS facility. RHT

has a weighted average debt maturity

profile of 1.7 years. We believe that

there is minimal refinancing risk with the

establishment of the MTN Programme.

Interest Rate Risks

As at 31 March 2016, around 64% of RHT’s

advantage of the lower cost of borrowings

upon the commencement of operations of

the completed expansion and Greenfield

development projects. RHT does not hedge

currency exposure on the capital due to

the cost of such long term currency swaps

and fluctuation of valuation of underlying

assets which are carried at fair value. The

Trustee-Manager will continue to monitor

the policy and make adjustments if the

prevailing market conditions warrant it.

Liquidity risk

The Trustee-Manager monitors and

maintains a level of cash and cash

equivalents, through a balance between

continuity funding and flexibility through

the use of stand-by credit facilities

against RHT's financial obligations

deemed adequate to meet RHT’s financial

obligations. The Trustee-Manager intends

to retain a portion of RHT’s Distributable

Income, amongst other things, to mitigate

such liquidity risk. The cash generated from

India operations are placed in bank fixed

deposit and mutual funds to maximise

interest income prior to the intended

repatriation.

Distribution Policy

RHT’s current policy is to distribute at

least 90% of its Distributable Income.

The Trustee-Manager has distributed

100% of RHT’s Distributable Income since

its Initial Public Offering. The Trustee-

Manager intends to distribute 95% of its

Distributable Income for the period ending

31 March 2017.

loans and borrowings are exposed to

interest rates risk as they are pegged to

the Singapore Swap Offer Rate ("SOR") and

Indian Base Rate. In view of the current

volatility of the SOR, the Trustee-Manager

issued S$60m fixed rate notes to refinance

an existing S$60m floating rate facility. RHT

has benefit from the decreasing Indian Base

Rate since utilising the Rupee loan during

the year. We will continue to monitor the

cost of entering into interest rate swaps to

mitigate the interest rate risks.

Currency Risk

All of RHT's assets and operations are

currently within India, thereby deriving all

its revenue from India. At the same time,

the distributions to unitholders are paid

in Singapore dollars. In recognition of the

consequential currency risk, Management

has adopted the policy of hedging the

anticipated amount of cash flows coming

from India to Singapore. Distributions are

paid out to unitholders on a semi-annual

basis and forward contracts locking in

the currency conversion rates are entered

into one year before the cash flows are

repatriated from India to Singapore. This

mitigates the risk of any Indian rupee

volatility in the period before income is

repatriated to Singapore.

RHT takes on Rupee borrowings for major

expansion and Greenfield development

projects as natural hedge to the currency

mismatch. Based on its current policy,

RHT will refinance the Rupee borrowings

with Singapore Dollar borrowing to take

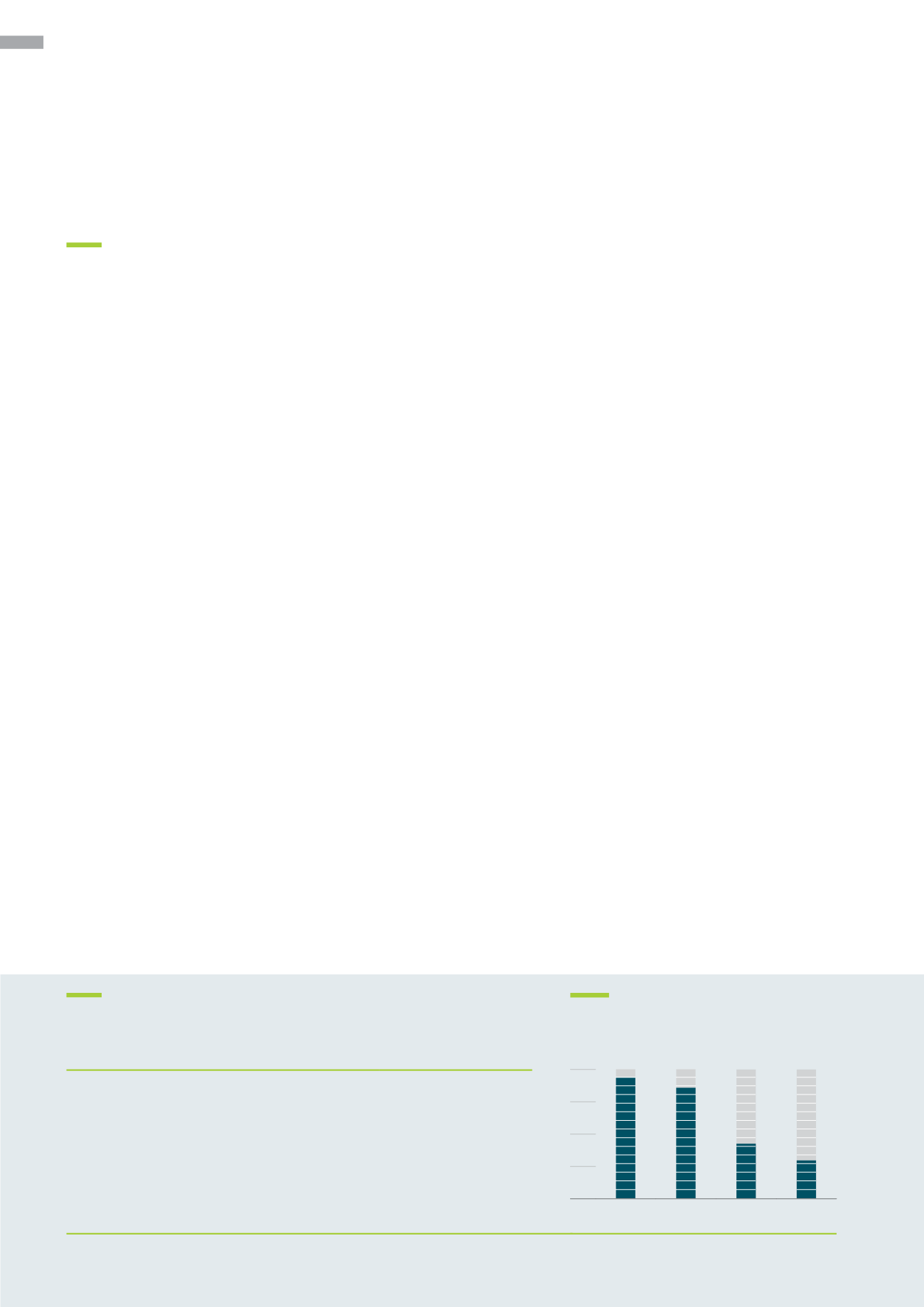

OVERVIEW

KEY INDICATORS

Indicator

As at 31 March 2016

Gearing Ratio

18.1%

Interest Coverage Ratio

9.6 times

Percentage of Fixed Rate Debt

36.1%

Effective Weighted Average Cost of Debt

4.88%

Average Hedged Rates

Jun 16

49.58

Dec 16

49.35

1

Interest Coverage Ratio is defined as the ratio between EBITDA divided by Financial Expense including interest capitalized during the year

Healthy INTERESTCOVERAGERATIO

(1)

Ratio (x)

Interest Coverage Ratio ("ICR") (x)

32

24

16

8

0

FY13

FY14

FY15

FY16 YTD

30.1x

27.4x

13.5x

9.6x

006

Religare Health Trust