Growth

Strategy

ASSET MANAGEMENT

AND ENHANCEMENT

Within RHT’s existing portfolio, there is the

potential for organic expansion. The total

number of beds that are currently being

operated at RHT’s Clinical Establishments and

Operating Hospitals is 2,645 beds. There is the

potential to increase this number of operating

beds to 3,593 through expansion works, such

as the addition of more floors or new blocks

within the existing structure or compound.

Management also discusses with the operator

on the new types of medical programs which

they are looking to offer, and if agreed will

revamp the facilities in order to meet these

needs. The aim of both the operator and

management is to fit out the facilities to be

able to provide increasingly higher value and

more sophisticated medical treatments.

Capacity Enhancement

Initiatives Underway

Addition of a 200 bed Oncology block at

BG Road Clinical Establishment

Addition of a Maternal and Child Health

(“MCH”) program at Noida Clinical

Establishment which will add 40 beds by

end FY2017

Addition of 50 beds at Mulund Clinical

Establishment

Addition of 40 beds at Jaipur Clinical

Establishment

the Clinical Establishment that it owns.

Where Fortis intends to dispose of any of

its Clinical Establishments, it must first

be offered to RHT. Currently the clinical

establishments owned by Fortis which are

potential ROFR assets, are relatively young

hospitals. RHT, will, if the assets are offered,

evaluate these assets. This is unlikely to

occur before they are operationally stable.

Fortis is focusing its efforts on the Indian

healthcare market and disposed of all

its international healthcare operations.

With Fortis concentrating on the Indian

healthcare market, they may develop

more clinical establishments. Such clinical

establishments will also be potential

ROFR assets.

Potential Third Party Acquisitions

Management recognises that third party

acquisitions represent a key source of

new assets. We are constantly evaluating

potential yield accretive acquisitions to

enhance RHT’s portfolio. We focus our

efforts on clinical establishments which

are strategically located and suitable for

the provision of multi-specialty medical

services. In the short term, we are intending

to remain in India where we have the

ground knowledge and network for

sourcing potential acquisitions.

Addition of 102 beds at Amritsar

Clinical Establishment by end FY2017

Addition of 60 beds, two operating

theatres and a catherisation laboratory

at Nagarbhavi Operating Hospital

Mohali land with a potential bed

capacity of 500 beds

Development Project Pipeline

RHT has four Greenfield Clinical

Establishments in its portfolio – Ludhiana,

Chennai, Hyderabad, Greater Noida.

Together, these four Greenfield Clinical

Establishments have a potential capacity of

874 beds.

Currently, the Ludhiana Greenfield Clinical

Establishment is under development and

is expected to be ready by FY2017. The

Ludhiana Greenfield Clinical Establishment

will specialise in the provision of Mother

and Child related medical programs once

it is completed. In FY2015, the Trustee-

Manager acquired a piece of freehold land

adjacent to the existing Mohali Clinical

Establishment that has a potential bed

capacity of 500 beds once developed.

INVESTMENTS

Right of First Refusal Assets

Fortis, the sponsor of RHT, has granted RHT

the Right of First Refusal (“ROFR”) over

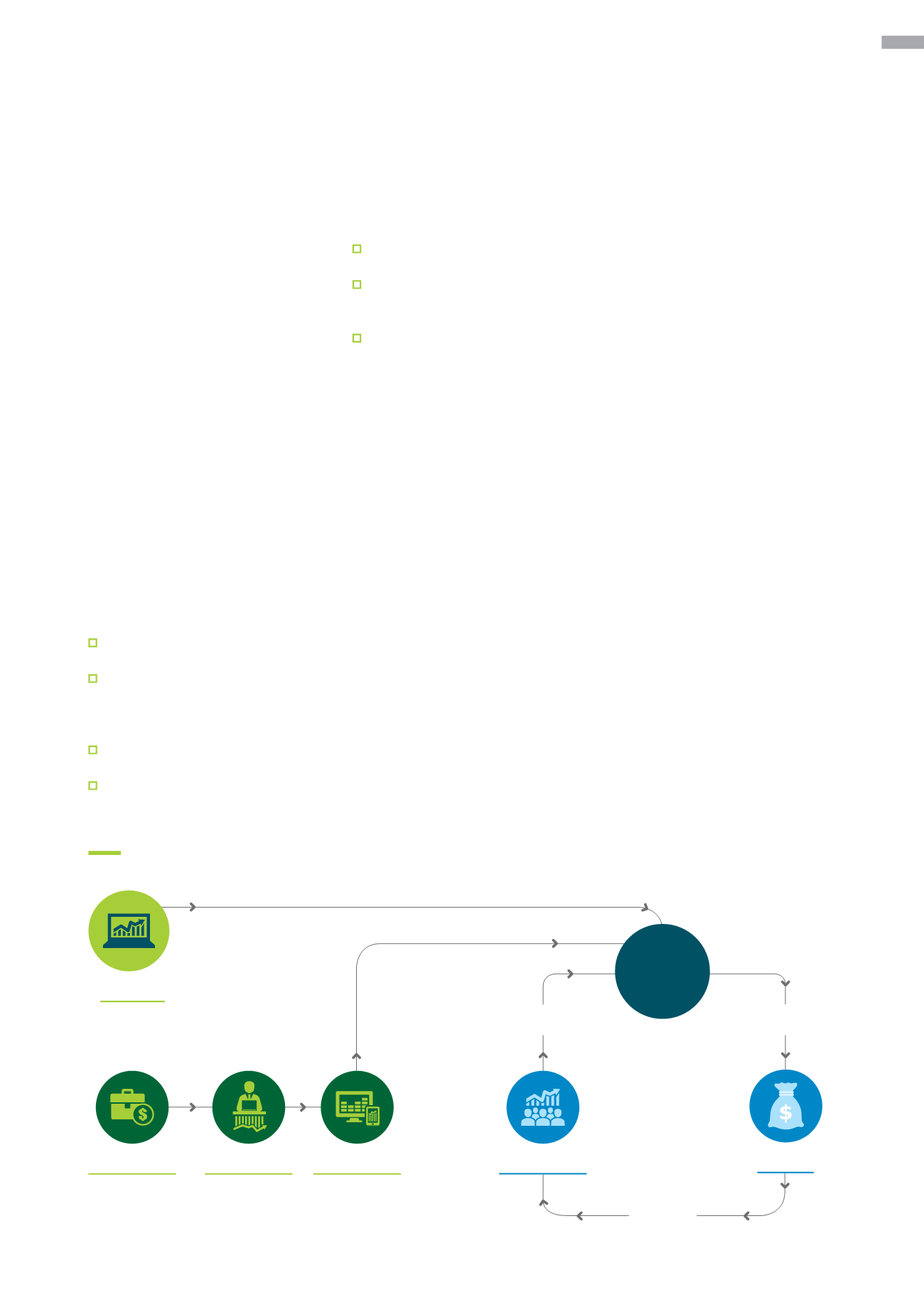

Owns RHT Units

What we do

WHAT AFFECTS US

RHT

Service Fees &Other Income

DPU

CAPITAL

MANAGEMENT

ASSET

MANAGEMENT

investment

MANAGEMENT

– Fortis Healthcare

Limited ("Fortis")

– Institutional &

public investors

UNITHOLDERS

REVENUE

Market

factors

– Indian economy

– Indian healthcare industry

Annual report FY2016

013